Public cloud winners take all

It is earnings season for the public cloud vendors and the chatter over who is winning is heating up. Microsoft was first, reporting 64% growth on a base that no one outside of Microsoft seems to know (though Forrester is projecting $10 to $11 billion (€9 to 9.9 billion) in 2019). Some observers, like former Windows chief Steven Sinofsky, doubt the number can possibly be “impressive” or Microsoft would break out Azure revenue. Others speculate that whatever the Azure number is, it likely includes a fair amount of “hybrid cloud” mixture of on-premises and in-the-cloud services.

Not that it matters.

Whatever Azure’s numbers, and whatever the AWS numbers (much bigger) or the Google figures (much smaller), the only number that really matters is the overall percentage of IT spending that goes to cloud. While that number has historically been comparatively small, it is set to rise considerably, with the bulk of that spending going to the top three cloud vendors, as a recent Credit Suisse survey of CIOs illuminates.

AWS, Azure, Google Cloud

Gartner just released an update to its Magic Quadrant for Cloud Infrastructure as a Service, and it is remarkable how little the venerable analyst firm had to say. That is not intended as a slight on Gartner, but rather an observation of just how little has changed.

As before, AWS, Microsoft, and Google make it into the Leaders quadrant. And as before, everyone else is largely a rounding error. For example, Alibaba gets credited as the top cloud in China, but Gartner also points out that “Alibaba Cloud’s financial losses are increasing and may prevent the company from continuing to invest in necessary expansions.” Not good. Meanwhile, Oracle keeps selling almost entirely to existing Oracle accounts (who presumably cannot escape), with little hope of expanding: “Oracle is unlikely to ever be viewed by the market as a general-purpose provider of integrated IaaS and PaaS offerings.” IBM gets much the same treatment.

Which leaves us with the three leaders. Little has changed in Gartner’s assessment of AWS, Microsoft Azure, and Google Cloud. AWS, unsurprisingly, gets credited as “the most mature, enterprise-ready provider” and, as such, “enterprises make larger annual financial commitments to AWS” than other cloud providers. Microsoft keeps using its enterprise heft to drag Azure into its hitherto on-premises customers, while Google Cloud keeps getting noted for innovative technology (and a seemingly eternal inability to go all-in on enterprise).

In other words, it is “as you were” in cloud land, with each passing quarter signalling that, barring some unforeseen event, enterprises will continue to buy from the early leaders and continue to ignore the early laggards.

Buying IT innovation

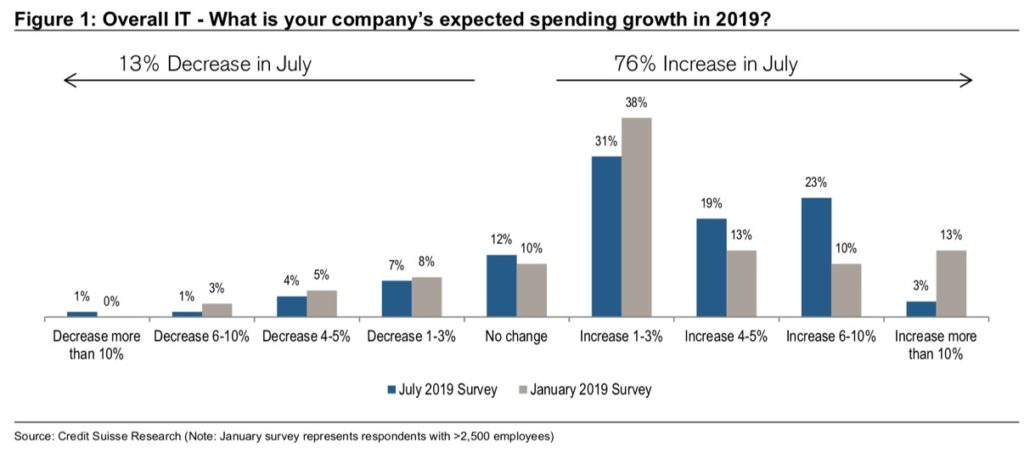

Credit Suisse regularly polls CIOs at large enterprises throughout the US and Europe to gauge IT spending patterns. In its July 2019 update, CIOs overwhelmingly expect to increase spending through the second half of 2019:

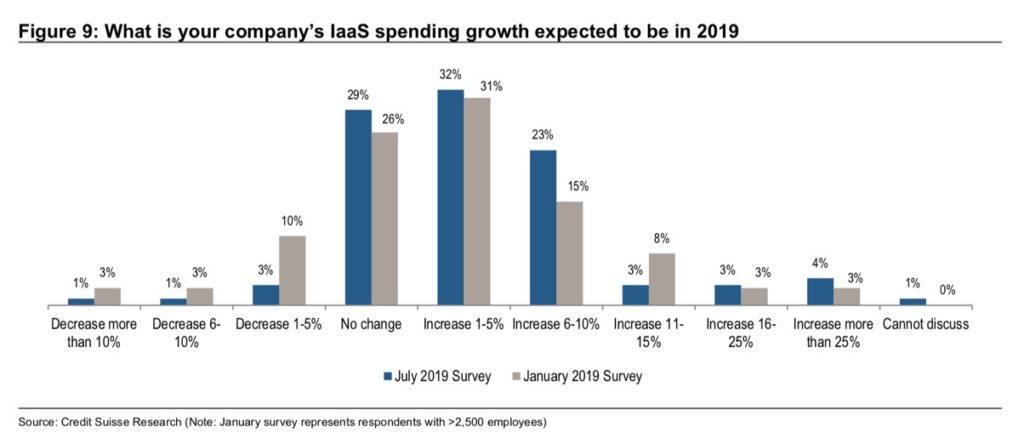

One big area benefiting from this upward trend in spending is IaaS:

Importantly, while public cloud currently accounts for just 11% of IT budgets in 2019, that percentage is expected to nearly double by 2020 (20%) and almost triple by 2022 (31%).

That is huge, and it is spurred by a desire for greater business agility and access to new technology. Just 29% of CIOs are pushing into the cloud to try to squeeze costs. Cloud is an innovation engine, not a poor person’s server.

So, who is winning?

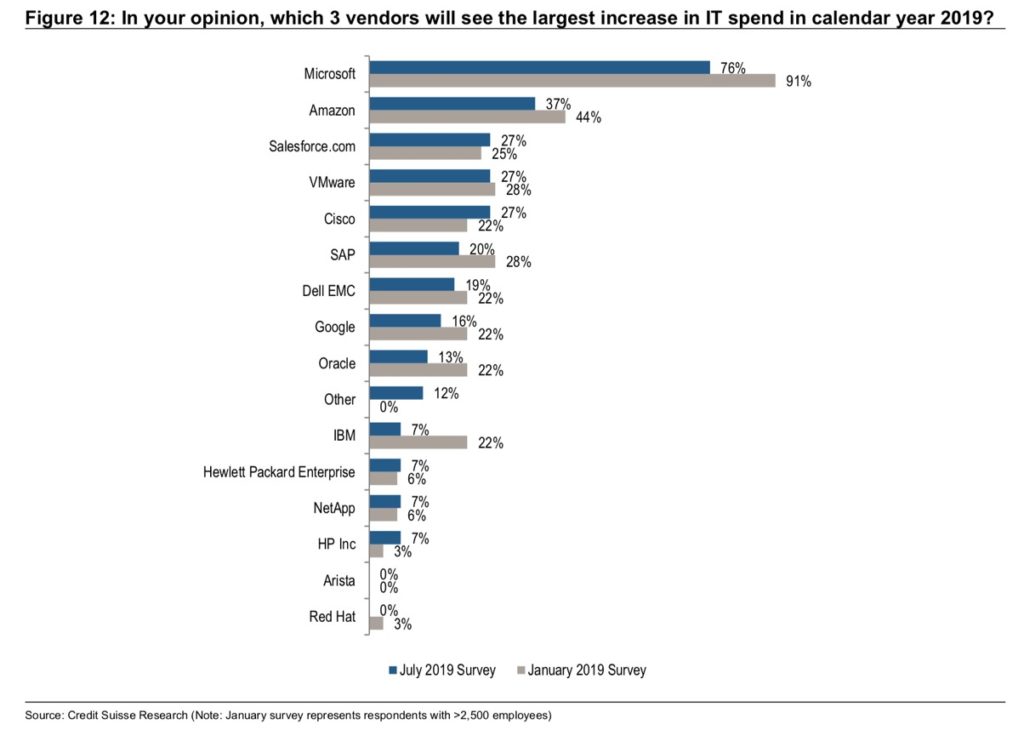

Given the Gartner MQ, it is not even remotely surprising to find AWS and Microsoft topping the list of IT vendors expected to see the biggest increases in spending in 2019, with Google also making it into the top eight:

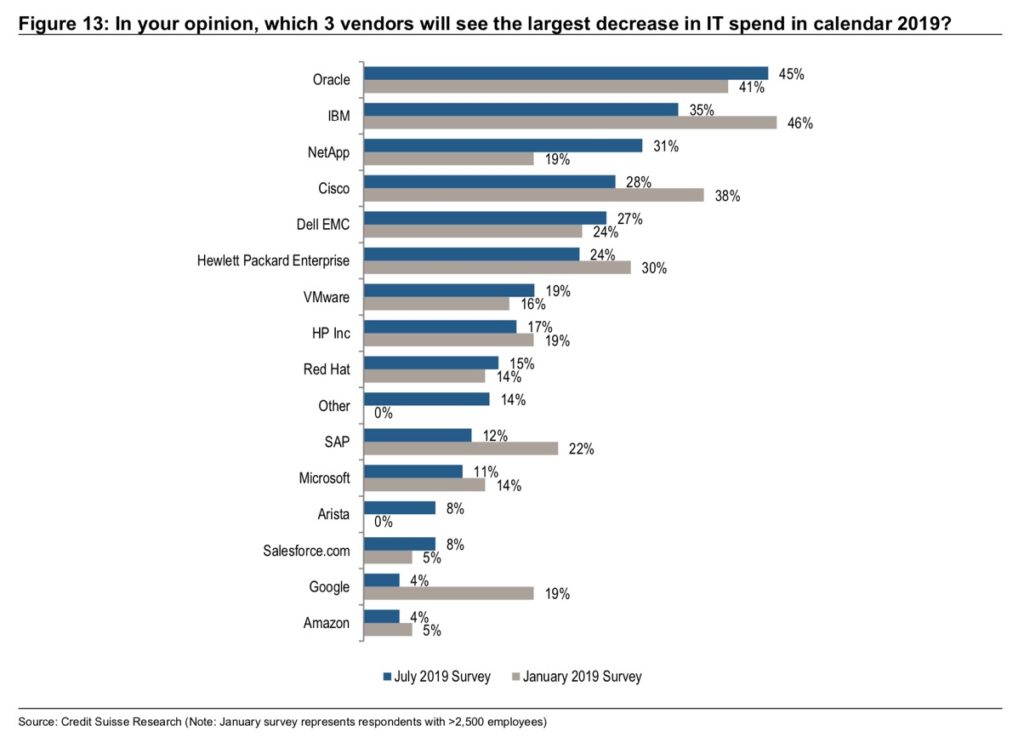

As for companies expected to see big decreases in IT spending, well, they are the ones without a strong public cloud game:

The first list (IT increases) is obviously the one to be on, particularly given the fact that 44% of CIOs surveyed are prioritising public cloud in 2019, with another 44% citing hybrid cloud. The only thing bigger than these two is security software (52%), largely driven by a continued inability to keep hackers from exploiting IT vulnerabilities.

In short, we are firmly settled into the beginning of the cloud era. Customers are also seemingly settled on which vendors they trust to deliver increased business agility and innovation. One might think this would lead the public cloud vendors to get lazy on their largesse. That doesn’t seem to be happening. Instead we’re seeing an incredible increase in the pace of innovation across the major cloud vendors. It’s a great time to be buying IT, and an even better time to be a developer building the future.

IDG News Service

Subscribers 0

Fans 0

Followers 0

Followers