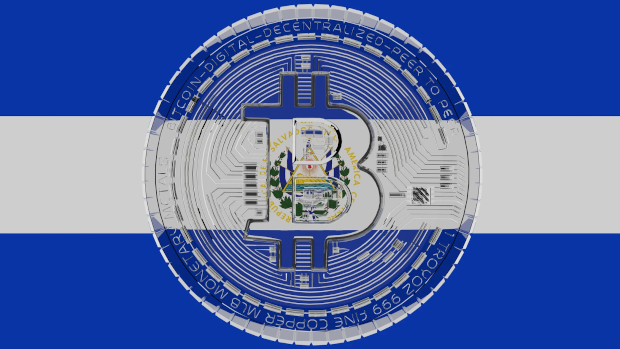

El Salvador becomes the first nation to adopt Bitcoin as legal tender

Lawmakers in the Central American country of El Salvador have voted to consider Bitcoin as legal tender, with citizens able to trade freely for goods and services using the digital token, as well as pay their taxes.

Measures agreed on by the nation’s parliament will see Bitcoin regulated as ‘unrestricted legal tender’ with people able to make unlimited transactions, and businesses compelled to accept payment in the digital currency.

Citizens can also pay their taxes in Bitcoin, while exchanges in Bitcoin won’t be subject to capital gains tax, just as with any other legal tender in the nation, as opposed to an asset.

The shock move comes as a swathe of institutions have distanced themselves from Bitcoin due to a variety of reasons, chief among them being the fact that its value fluctuates so wildly. This is one of the main reasons why nations and businesses across the world have so far been reluctant to adopt it as legal tender.

In the space of six months, Bitcoin has swung in value from under $15,000 in early November 2020, to $40,000 in January 2021 to $30,000 a month later, before hovering between $55,000 and $65,000 over subsequent months and crashing in May to little more than $33,000 at the time of writing.

El Salvador’s Bitcoin law, however, will indeed tie the value of Bitcoin to the US dollar (USD) as determined by the market. The USD is the country’s primary currency.

The state will also work to establish the infrastructure to apply the law, and promote training and mechanisms so the wider population can access Bitcoin to pay for goods and services.

According to a decree published by the legislative assembly, roughly 70% of the country doesn’t have access to traditional or legacy financial services. The legislature, therefore, sees digital currencies as the ideal chance to involve more people in the financial system, while also promoting economic growth.

The law, which was approved by 62 out of 84 votes in the Salvadoran Congress, will come into force roughly 90 days from now. Between now and then the country’s central bank will establish a trust to automatically and instantly convert Bitcoin to USD.

“Where El Salvador has led, we can expect other developing countries to follow,” said Nigel Green, the CEO of deVere Group, a financial consultancy. “This is because low-income countries have long suffered because their currencies are weak and extremely vulnerable to market changes and that triggers rampant inflation.

“This is why most developing countries become reliant upon major ‘first-world’ currencies, such as the US dollar, to complete transactions. But reliance on another country’s currency also comes with its own set of, often very costly, problems.”

Several organisations such as PayPal have moved in recent months to support cryptocurrencies as a means to pay for goods and services, with recent changes allowing PayPal customers to store digital tokens in their online wallets. Other institutions, such as Mastercard and HSBC have deemed Bitcoin too unstable to reasonably support.

Many nations, too, have distanced themselves from Bitcoin, and other digital currencies. Turkey, for example, is banning the use of Bitcoin due to the “high risk of fraud”, while China’s effective ban against cryptocurrencies sparked the downturn last month.

© Dennis Publishing

Subscribers 0

Fans 0

Followers 0

Followers