For all the marketing around B2B electronic payment platforms, many of which are based on blockchain, there are few actual users of the technology – even though it purports to reduce the time needed to send, clear and settle global payments from days to seconds.

The technology enables the representation of digital currency (a “stable coin”) backed by traditional fiat money, or the creation of cryptocurrencies (a new asset class) such as bitcoin or Ethereum, Ripple’s XRP or Stellar’s Lumen, enabling new sources of liquidity. Those digital assets are transmitted across a decentralised network where transactions are recorded on an immutable blockchain ledger.

“The revolution we’re seeing is from a cross-border perspective,” said Fabio Chesini, a Gartner research director for transaction banking. “If you think about a cryptocurrency like a bitcoin, when you move money from point a to point b, you’re actually encapsulating the message and the settlement in the same transaction. That’s possible because a cryptocurrency is the first native digital asset ever created, which means an asset that has no liability from somewhere else.”

PNC and RippleNet

For example, US bank PNC recently announced its PNC Treasury Management division is now a member of RippleNet, a blockchain-based network for transmitting real-time, cross-border payments. Pittsburg-based PNC is the ninth-largest US bank for assets and the 71st largest bank globally.

PNC is just one of more than 100 firms to join Ripple’s global payment network; members now include banks, payment providers and remittance companies.

“As the global economy becomes increasingly digital, the need for real-time payments globally is critical,” Chris Ward, executive vice president for PNC Treasury Management, said in a statement. “We are focused on providing our clients with capabilities that enable making secure digital payments in an instant, whether they are sent across the street or across the world.”

RippleNet allows financial services firms to use either government-backed currency or its own XRP cryptocurrency for payments. Ripple claims its network can settle a cryptocurrency transfer in four seconds, compared to Ethereum, which it claims takes two minutes or bitcoin, which can take more than an hour. Traditional settlements that use banking networks and clearing houses can take from three to five days.

However, International cash management banks, such as Citi, HSBC and Bank of America, have their own payment networks from which they receive transaction fees and other revenue, leaving some to ask why they would cannibalise their own business by using a third-party network.

Also, XRP tokens are pre-mined, meaning all the coins that will ever exist have been created, unlike bitcoin or Ethereum, where the number of cryptocurrencies has no limit and they are not backed by fiat money. Ripple created 100 billion XRP coins, but the primary company and Ripple Labs – the subsidiary that created the payment protocol and exchange network – own 60% of the tokens.

If, for whatever reason, those additional tokens were put in circulation, they would affect the XRP’s price.

“Some people may think there is a risk that Ripple would ‘dump’ XRP on the market. However, Ripple has 55 [billion] XRP locked in escrow,” a Ripple spokesperson said via emial, explaining the company holds only about 13% of the outstanding XRP coins.

“Ripple’s goal is to thoughtfully enable the XRP ecosystem by incentivising customers and partners so it wouldn’t make sense as a business to hurt the XRP Ledger by flooding the market,” the spokesperson said.

Ripple now claims to have 11 of the world’s top 100 banks by total assets as its customers, including JP Morgan Chase, Mitsubishi UFJ Financial Group and Credit Agricole. Bank of America and Santander are also members of RippleNet, though not all of the banks have actually deployed its payment platform.

When asked how many of those banks are actually using the RippleNet to transfer funds, a Ripple spokesperson said: “RippleNet members are in various states of deploying Ripple for commercial use.”

Why banks are going slow

“We’re seeing a lot of announcements about Ripple and the banks they’re actively promoting in the media, but they’re not actually using it in a mainstream production way,” Chesini said. “They have very limited pilots in production. Moreover, they’re using the messaging capabilities that the Ripple platform provides them, but they’re not using XRP.

“Banks are wary due to several implications, such as the cannibalisation consequences of the FX business by shifting to a more open-market-making ecosystem and the risk implications of introducing a new asset class, pre-mined and centrally distributed at inception such as the Ripple XRP. Using a new infrastructure rail based on blockchain by using them for messaging [does] not have a clear business case for banks when [they’re] considering replacing existing traditional correspondent banking services. Also, [it’s] worth highlighting the novelty of these platforms and their lack of maturity for being used in mission-critical businesses such as cross-border payments,” Chesini argued

The RippleNet payments exchange network is now live in 40 countries, including recent entrants from North America, Asia, Africa, Europe and South America, according to a statement from Ripple.

“Working with leading blockchain technologies allows us to maintain our promise of driving down the cost of cross-border payments, combined with access to faster, more secure money transfers to even more corridors across the globe,” Paresh Davdra, CEO of payment provider Xendpay, said in a statement.

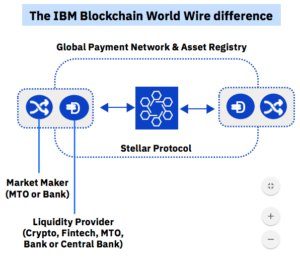

Similar B2B payment networks have also been launched by traditional tech providers. For example, IBM is launching World Wire, an electronic cross-border payments, clearing and settlement platform based on blockchain and the Stellar open-source protocol. And Consensys is launching Adhara, a similar cross-border payments platform.

IBM World Wire exchange IBM

Consensys participated in a recent proof of concept with the South African Reserve Bank on a payment system for a [real-time gross settlement] RTGS.

Last week, MasterCard and Microsoft announced MasterCard Track, a B2B supply chain platform that includes a global payment network.

Last year, JP Morgan created what was arguably one of the largest blockchain payments networks at the time: the Interbank Information Network (IIN), which it said will significantly reduce the number of participants needed to respond to compliance and other data-related inquiries that delay payments.

If the digital currency is backed by fiat money, however, the clearance and settlement process still requires a central authority, i.e., a central bank.

So far, those promoting blockchain for cross-border transfers have yet to define “a clear, precise reason from a settlement perspective of why it’s needed,” Chesini said, explaining the funds still require a central banking authority behind it.

“Because we’re dealing with assets that have a counterpart liability, we will never be able to get rid of that and that’s why I’m really sceptical about them using blockchain technology for dealing with real-life assets with counterpart liabilities,” Chesini said.

So far, those promoting blockchain for cross-border transfers have yet to define “a clear, precise reason from a settlement perspective of why it’s needed,” Chesini said, explaining the funds still require a central banking authority behind it.

“Because we’re dealing with assets that have a counterpart liability, we will never be able to get rid of that and that’s why I’m really sceptical about them using blockchain technology for dealing with real-life assets with counterpart liabilities,” Chesini said.

IDG News Service

Subscribers 0

Fans 0

Followers 0

Followers